How to be More Strategic: How Samuel Odio led FiveStars out of a slowdown and into a $317m acquisition

As product managers, the advice to be “more strategic” often eludes us, clouded in business school jargon like SWOT analysis and vague directives. Genuine strategic thinking, however, is simpler (but not easy) than commonly believed.

In this article, we delve into the transformative journey of Fivestars, examining how Samuel Odio’s strategic pivot as Head of Product led the company out of slow growth to a $317m acquisition in 2021.

While the success stories of behemoths like Amazon, Tesla, and Google dominate headlines, Product Managers at Work covers the ground-level view that demystifies the strategic decisions propelling growth and transformation at startups. Fivestars is a story of exactly that.

Fivestars’ founding story

Fivestars was founded as a customer loyalty company targeting small businesses. Customers buying coffee at a local cafe with Fivestars Loyalty would see a tablet beside the register prompting them to sign up for a rewards program. Customers would simply enter their phone number to earn points for free drinks in the future. Merchants, meanwhile, benefitted from more loyal return customers. It was a win-win.

In the company’s early days, Fivestars used paid acquisition to maintain 70% annual growth. But as the Facebook and Google ads markets saturated, the increasing cost of ads forced painful tradeoffs between a healthy customer acquisition cost (CAC) and growth. They could no longer affordably grow lead volume.

Moreover, the company faced challenges with customer retention. Managing a 3% monthly churn rate becomes more challenging when it applies to 10,000 merchants rather than just 100. As the base of merchants grew, it became intractable to offset churn with paid acquisition. Consequently, even as the company continued to grow, it was approaching a plateau. Fivestars needed an innovative strategy to attract more merchants while retaining the existing ones.

In 2016 the CEO of Fivestars asked Samuel Odio to lead the change as the Head of Product. Odio was a serial founder and CEO. His first startup out of college was acquired by Facebook, making him the first PM for Facebook Photos. During his time at Facebook, Odio released an AI image classification architecture and grew the product to over 100 million photo uploads and 10 billion daily photo views. He then went on to found another startup which Twitter later acquired. Odio arrived at fivestars with over nine years of experience as a product manager and founder.

Good strategy doesn’t start with fancy diagrams, it starts with thoughtful tests.

When Odio founded his first company, he thought that a good strategy was simple: listen to your customers and execute well. Odio later discovered many products might initially meet the needs of their users but, despite solid execution, not flourish into sustainable businesses (if you’re a millennial, shed a tear for TiVO). And once a business is struggling, it’s hard to invest in a better product that users want. It’s a vicious cycle. Moreover, strategies age as the environment a company operates in evolves. What was once a self-reinforcing, profitable well-oiled machine often becomes a liability (i.e. Blockbuster Video).

For that reason, most successful, long-lasting businesses have had to shift attention and resources from their existing product to bet on something new. When Odio joined Fivestars, the future of the company and its employees depended on getting the strategy right.

When faced with such circumstances, many PMs will rush to produce an immediate solution. Often this takes the form of a snazzy PowerPoint drafted during a late-night work session fueled by coffee and a prayer. But good strategy rarely comes in such a flash; a compelling PowerPoint might relieve stress, but only momentarily.

Like good investing, arriving at a good strategy is an exercise in opposites: it’s both an intentional and a random walk. Strategists inspect the organization’s current plan, seeking out common assumptions that if proven incorrect, reveal significant opportunities. Only after challenging and testing those key assumptions can a leader present a credible alternative plan.

Upon arriving at Fivestars, Odio knew this process of identifying and validating assumptions would take time and iteration. He also knew that no single iteration would predictably hold the key to Fivestars new product direction. However taken as a whole, these lean tests would tell a story that would inform a winning strategy.

This lean hypothesis testing approach would require Odio to build trust with key stakeholders within the company, starting by setting clear expectations with the CEO:

This will be a 2-year project, and we will be running many experiments which sometimes may take away resources from building things that our existing customers are asking us to build. There won’t be home runs, but many iterative changes that over a period of time accumulate into a meaningful impact. Will you back me up on this ambiguous journey and provide me with the resources and patience to get there?

Aligning expectations with the CEO was key. Only when the CEO responded with, “Yes, I got your back, and I also expect that there may be difficult conversations among executives that I’ll have to mediate”, did Odio get to work.

Good strategy is a story that’s widely understood and believed.

Strategy is ultimately a framework to align a group of people (a team or company) around a common objective and plan. Communicating the strategy is as challenging as creating it. A strategy cannot be successful until it is understood by the people who are tasked to execute it. Many leaders use complex jargon to build credibility, but that’s counterproductive as the audience will struggle when it comes time to execute the plan.

As a new leader at the organization, it was particularly difficult for Odio to garner buy-in from other leaders. Some advocated for a focus on the legacy product, given their personal incentives that aligned with maintaining the status quo (e.g. near-term financial quotas). It was even more challenging to convince the lieutenants of those leaders to embrace the pivot. Odio leveraged trust building skills to convince whoever he could that it was worth sacrificing short term gains for long-term victory.

How the (strategic) sausage got made: a 2-year journey.

As Fivestars was approaching a point where it could no longer grow exponentially, Odio’s goal was to pivot Fivestars to drive a network effect that created lock-in (reducing merchant churn) and organic growth (reducing costly ad spend).

Will interconnections reduce churn and create a foundation for organic growth?

The user-research team learned that merchants valued acquisition (a new customer walking into the store) above all other value propositions. This was surprising - as the company’s merchants had all bought into the concept of loyalty and valued returning customers.

Since Fivestars signed up over one million consumers per month, Odio saw an opportunity to create network lock-in by moving those consumers to other nearby Fivestars businesses. With this, Odio crafted the set of hypothesis to test, asking questions like:

Can we move consumers from a Fivestars location they love to a Fivestars merchant down the street?

Will merchants value that in-network acquisition?

Can we do it in enough volume to meaningfully reduce churn?

Once we are moving consumers inside the Fivestars network of merchants, can we also send them to a non-Fivestars merchant? Could those merchants become organic leads for the sales team, increasing growth?

Ultimately, Odio identified close to a hundred hypotheses and tested two dozen. Similar to the RICE (reach, impact, confidence, effort) framework for ranking product features, Odio ranked the hypotheses by their confidence, impact on the strategy (if disproven), and ease of validating (many hypotheses could be validated without touching code).

To get a sense of the hypotheses tested, we describe three hypotheses to reduce churn:

1: Nearby deals - A geographically dense set of merchants advertising deals to each-other’s customers will reduce churn (disproven).

2: Wifi - Free wifi in store will drive more signups, increasing the penetration of consumers at a merchant, reducing churn (disproven).

3: Pay - Inserting loyalty into the checkout experience (e.g., displaying it on the credit card terminal), will increase exposure, drive more signups, increase the penetration of consumers at a merchant, thereby reducing churn.

Our new product strategy must create indispensable connections.

Hypothesis 1: Nearby deals - A dense set merchants advertising deals to each-other’s customers will reduce churn (disproven).

Odio hypothesized that moving consumers within the Fivestars network would require both (a) displaying a relevant deal to the consumer from a nearby merchant and (b) a critical mass of merchants nearby to train the user to expect such rewards.

In other words, if a customer was accumulating loyalty rewards at their favorite cafe and saw an offer on Fivestars at a restaurant twenty miles away, it was unlikely they would make the trip. But if Fivestars flooded one city with many Fivestars merchants, then one customer might visit multiple stores if they saw local deals at nearby shops.

Rather than ship a product to all 13,000 merchants and 70 million consumers, Odio’s goal was to create a prototype that they would deploy in one small geographic area with favorable attributes (e.g., merchant density). His thesis was that, if the team can’t make it successful when the cards are stacked in the company’s favor, it likely won’t be successful at scale.

Odio and his team chose Capitola, California as a test bed. They moved to an Airbnb nearby, taking over the town with a variation of the Loyalty product that marketed the nearby network of merchants. Fivestars committed substantial resources to this pilot program, relocating some of their best sales reps, user researchers, designers, and product managers to Capitola to sell this new prototype.

This test diverted attention and resources from the legacy product that was already generating revenue. This “innovators dilemma” certainly caused some short-term contention on the team.

Setting the right bar for success

Great product managers keep their teams focused on the most impactful tasks by establishing clear success criteria for an experiment. Setting good success criteria requires being in tune with the intersection of your business objectives and what your customers really care about. The best way to get in tune, according to Odio, was to spend a lot of time with merchants. Odio spent a lot of time with merchants to understand what would meaningfully impact their business – he set the success criteria as “5 new visitors per month” for a Fivestars merchant.

Ultimately, the team reached a density of three Fivestars locations on every block in downtown Capitola (about 20 locations total). Despite this effort, the results revealed that driving density did not lead to the needed network effects.

While this failure was disappointing for the team, it was part of the innovation process. Odio guided his team forward, prioritizing learning and adaptation in the face of unexpected results.

Hypothesis 2: Wifi - Free wifi in store will drive more signups, increasing the penetration of consumers at a merchant, reducing churn (disproven).

Learning that merchant density alone was not enough to drive a network effect, Odio shifted to test whether increasing consumer sign-ups directly at the point-of-sale could reduce churn and increase the top-of-funnel size of the customer base (increasing network size). Strengthening this hypothesis was the fact that in-store consumer signups were strongly and inversely correlated with merchant churn.

While signups in store would drive more return visits to that store (and increase the size of the overall consumer base), Odio knew it wouldn’t create a network effect. While not the complete solution, it was a more tractable problem.

The team launched their second experiment by offering free wifi at eight Fivestars merchants. Odio’s hypothesis was that by increasing the value of Fivestars to customers, they could increase the number of customer sign-ups, creating more opportunities to drive repeat and new purchases.

The results were promising at first: overall customer sign-ups increased by 40%, making this their most successful test thus far. However, good product managers also understand the underlying change they’re really trying to affect. Upon closer examination of long-term data, Odio observed that while more customers were registering for Fivestars, this increase did not translate into more frequent visits or higher value purchases at the merchants. They also weren’t particularly likely to visit other nearby merchants. These consumers tended to ignore any rewards presented to them and instead focused on their immediate goal: getting wifi.

Given the complexity of installing and maintaining wifi routers – and considering the lack of desired second-order effects – this was yet another failed experiment.. Odio moved on to the next hypothesis.

Hypothesis 3: Pay - Inserting loyalty into the checkout experience (e.g., displaying it on the credit card terminal), will increase top-of-funnel impressions, drive more signups, increase exposure to consumers at a merchant, thereby reducing churn.

Using learnings from the wifi experiment, Odio iterated on his hypothesis from simply driving sign-ups, to driving meaningful sign-ups. While wifi didn’t provide meaningful value to the merchant, the team’s third hypothesis was that allowing customers to prepay for their order would.

The team launched a pilot PrePay program where customers could load $20 into a Fivestars card to get $5, and an additional 5% cash back from every purchase.

While analyzing the PrePay program’s performance, the team discovered a significant insight: simply connecting a credit card reader to the loyalty tablet would triple consumer signups. It appeared that streamlining the loyalty process by allowing consumers to use the same device for loyalty and payments was a key driver of signups.

What’s more, the credit card terminal showed promise as a “loss leader:”

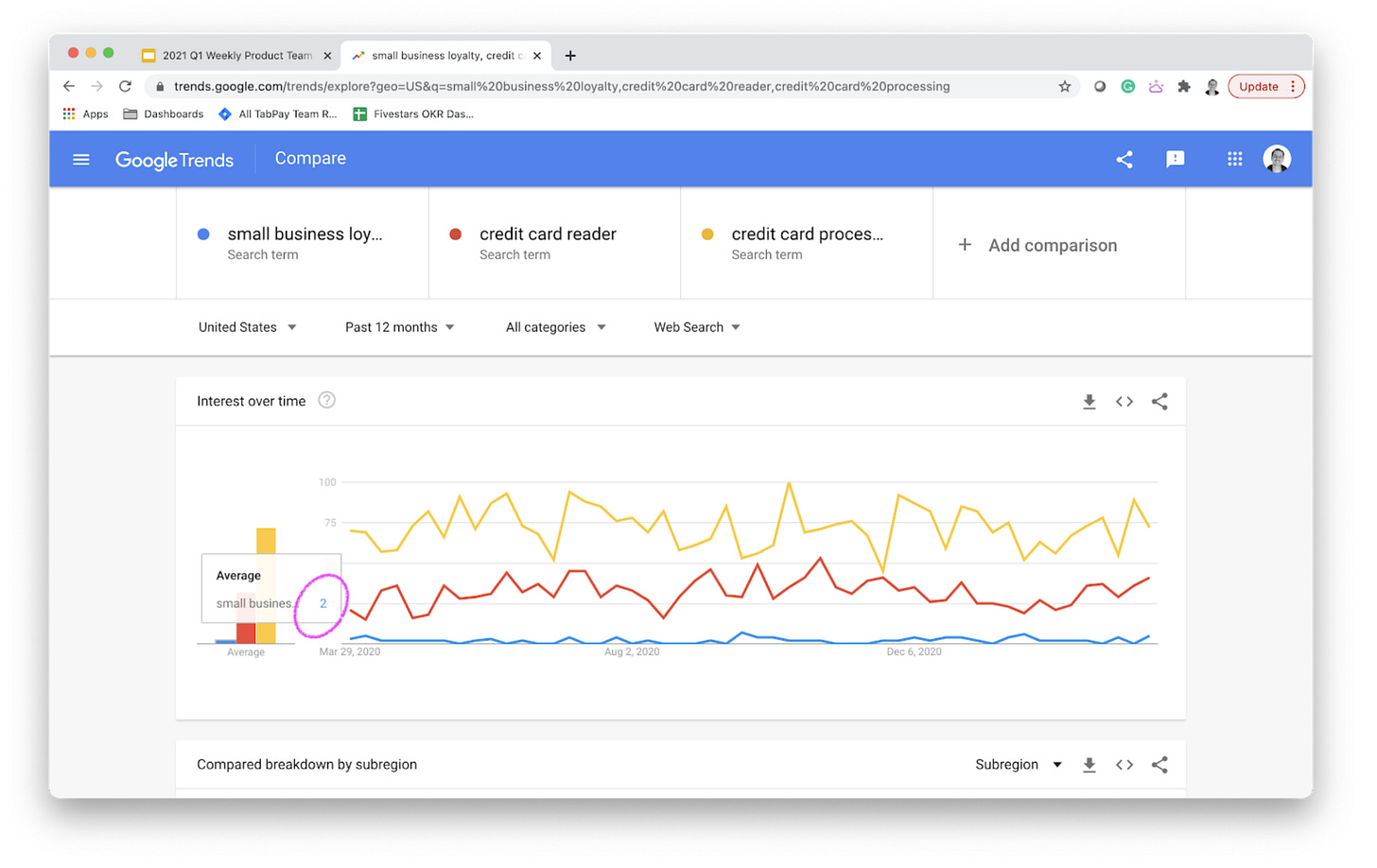

High lead volume: credit card readers were not a high-touch, evangelistic sale like loyalty was. An order of magnitude more merchants searched for card readers than those searching for loyalty programs.

Price sensitivity to credit card fees: Because the cost of the hardware could be subsidized by the loyalty subscription fee, Fivestars could lower the credit card processing fees they charged the merchant (a key decision criteria for merchants choosing credit card terminals).

Odio realized this product might meet the needs of both the user and business:

User (merchant): low-fee credit card processing + incremental revenue from loyalty

Fivestars: new marketing leads, driving growth, 3x more consumer signups.

Google search trends for “credit card processing” compared to “loyalty programs”

At that point, Odio worked with his team to flesh a more detailed strategy that could be validated:

Advertise online a credit card terminal with an industry-low transaction fee (merchants cared tremendously about credit card processing fees), benefiting from increased search volume.

Install a loyalty-enabled credit card terminal at the merchant that would, through organic usage, sign up most of that merchant’s consumers onto their loyalty program (3x the previous average).

Drive that database of consumers back into the store with personalized rewards, creating recurring revenue for the merchant.

Drive those consumers to other nearby Fivestars merchants, creating a network lock-in effect.

Drive those consumers to other merchants not on Fivestars, generating merchant interest in buying Fivestars because of the power of the network.

Once a merchant was onboarded, (2.a) and (3) would make it extremely difficult for Merchants to leave Fivestars, because as you know the #1 thing merchants care about is acquisition. Merchants couldn’t leave because leaving meant seeing fewer customers. The sales team would benefit from increased lead volume via (1) and get more organic interest via (4).

Ultimately, it was this strategy that, after further validation, became a company-wide pivot. Despite the significant technical risks involved in developing a credit card terminal and payments processing backend, early tests yielded promising results, justifying further investment. By the end of 2017, the CEO was ready to back the team’s plan, committing to Fivestars Pay as a product line. Two years later, Pay had become the company’s fastest-growing product. The culmination of this strategic pivot came in 2021 when SumUp, a globally recognized payments processor, purchased the Fivestars Pay product and company for $317 million.

Fivestars underwent a transformative journey under the direction of Odio, whose iterative testing approach uncovered a new payments business strategy. While loyalty was a successful first product, it lacked network effect characteristics that improved the product as the user base grew. Recognizing this gap and challenging its foundational assumptions led the team to a viable path to growth.

Reflection

In hindsight, the evolution of the hypothesis and the corresponding experiments appear clean and structured — but in reality, the process was messy. Odio and the team ran dozens of carefully tuned experiments. Reflecting on this iterative process, Odio shared insights into the essence of great product development:

Great product doesn't come from some lofty mission statement - but from strong user empathy and lean hypothesis testing. When I was a first time CEO, I thought you had to get the mission just perfect. Best products do not start with polished marketing speak, they start because someone has some degree of empathy and has discovered a way to solve both the needs of the user and the needs of the business.

95% of our tests fail - it's easy to over-invest in areas that you're intuitively excited about. It's best to take a diversified approach to product bets and match the level of investment to the results shown.

Over the span of two years, Odio and the team embarked on a journey of discovery, conducting many experiments that deepened their empathy for users. Each iteration brought them closer to a solution that resonated with the needs of Fivestars’ business, merchants, and consumers. Odio’s relentless pursuit of testing and learning ultimately produced a transformative strategy centered around Pay, culminating in a $317m acquisition by SumUp.

This piece was written as part of Product Managers at Work Partner Program. If you’re a product manager, startup founder, or executive interested in collaborating, we invite you to send us email at adrienneandalexis@gmail.com.

Editor’s note: Samuel Odio now works as an interim CPO and coach, having advised CEOs of companies of all sizes, Series A to publicly traded. Email coaching@odio.com to set up time with him.